Many San Diegans overwhelmed by debt often consider bankruptcy as a solution. However, choosing between Chapter 7 and Chapter 13 can be confusing.

Both work very differently. Picking the wrong one can cost you the very assets you’re trying to protect… or keep you chained to debt years longer than necessary.

Bankruptcy isn’t one-size-fits-all. The right chapter depends on your income, the property you want to protect, the type of debt you carry, and even local considerations here in San Diego.

So, in this blog, we’ll break down:

- How Chapter 7 works (and when it makes sense)

- How Chapter 13 works (and who it’s best for)

- A self-assessment checklist to figure out which chapter truly fits your financial situation

- Processes of both Chapters

By the end, you’ll know which path offers real relief and avoids painful mistakes. Keep Reading!

Chapter 7 Bankruptcy (For a quick & fresh start)

For many people, Chapter 7 feels like hitting the reset button.

It’s fast. It’s final. And when it’s the right fit, it’s often the quickest path to real relief.

But if you think “liquidation” in Chapter 7 means the court will show up and take away your house, car, and everything you own. That’s not how Chapter 7 actually works.

Let’s clear your concepts:

Misconception #1: “Do I lose everything?”

No. The law protects essentials through something called exemptions.

Exemptions are the legal shield that covers your essentials. In California, these protections are often more generous than in other states… but they must be applied carefully.

These exemptions save things like:

- Clothing

- Household goods

- Some equity in a car or home

- Retirement accounts

California law allows you to keep your San Diego residence even if you have up to $722,000 in equity in your primary home.

That’s why the idea of “liquidation” is misleading. Chapter 7 filers don’t actually lose assets because exemptions cover the basics.

But to protect your property isn’t automatic. California requires you to choose between two different sets of state exemptions (System 1 or System 2). Picking the right set (and applying them correctly) is one of the most important aspects of a bankruptcy case.

If an experienced bankruptcy lawyer handles it correctly, you keep what matters most. Otherwise, you risk losing assets you didn’t need to.

Misconception #2: “Do I need a certain amount of debt to qualify?”

No. There’s no magic number. What matters is whether you pass the means test. The mean test is a formula that looks at your income compared to your household size and the state median income.

If you qualify, Chapter 7 may be an option regardless of whether you owe $15,000 or $150,000.

Who Chapter 7 is best for

Chapter 7 is often the right fit for people who:

- Want to move forward quickly

- Don’t want to spend years making repayment plans

- Need a clean break from credit card balances, medical bills, and other unsecured debts

Chapter 13 Bankruptcy (For an affordable monthly plan)

If you have a consistent income, can stay disciplined with your payments, and can commit to the process for several years…, Chapter 13 will give you PROTECTION.

You’ll get a 3-5 year structured repayment plan (easily manageable).

Who Chapter 13 is for

This option is for people who want to protect assets and are willing to trade speed for security, like homeowners behind on their mortgage who want to keep their property.

This chapter allows you to stop foreclosure, catch up on missed payments, and keep the property you’ve worked hard for.

For many homeowners, that trade-off is worth it.

How it compares to debt consolidation

If you confuse Chapter 13 with debt consolidation… here’s the key difference:

- Debt consolidation is not a legal process. Creditors don’t have to agree, and lawsuits can still be filed against you. In fact, many debt consolidation programs fail because creditors simply refuse to cooperate.

- Chapter 13 bankruptcy is a legal process overseen by a federal judge. Creditors are required to accept the repayment plan once it’s approved by the court. Instead of uncertainty, you get the structure and protection of law.

Which Chapter Might Be Right for You

After knowing the basic difference between Chapter 7 and Chapter 13, you might be thinking… What would be best for me in San Diego?

Quick Self-Assessment Checklist

So, here’s the quick mini checklist from which you can do a self-assessment to get more clearer path before filing any bankruptcy chapter.

You might lean toward Chapter 7 if:

- Most of your debt is from credit cards, medical bills, or personal loans

- You have little to no disposable income left after basic living expenses

- You need fast relief and want to move forward in a matter of months

- You want a clean break without years of repayment commitments

You might lean toward Chapter 13 if:

- You’re behind on your mortgage but want to keep your home

- You need to catch up on car payments to avoid repossession

- You earn a steady paycheck that allows you to make regular payments

- Protecting your assets is more important than wiping out debt quickly

This checklist is only a start…. At SanDiegoBK, we help you confirm the right choice for your exact situation.

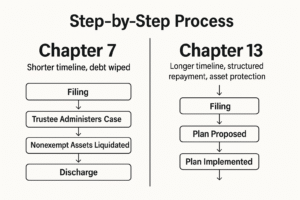

How Chapter 7 & Chapter 13 Work; Step-by-Step Process

Both Chapter 7 and Chapter 13 follow a clear process, but the outcomes are very different.

Chapter 7 Bankruptcy

This fast track’s process looks like this:

- Means Test

First, there is a determination of whether your income qualifies for Chapter 7 under California law.

- File Petition

Your case is officially filed with the bankruptcy court.

- Automatic Stay

The moment you file, creditors must stop calling, suing, garnishing wages, or attempting foreclosure.

- Trustee Review

A trustee, who is in charge of a bankruptcy, reviews your finances and exemptions. Exemptions will protect your essentials in most cases in California; therefore, to lose property.

- Liquidation (if needed)

Exceptional instances exist in which non-exempt property can be sold to repay the creditors.

- Discharge

Most unsecured debts (such as credit cards and medical bills) are washed away within a period of 4-6 months.

Chapter 13 Bankruptcy

This structured procedure looks like this:

- Steady Income Check

You must prove you have a consistent income to make plan payments.

- File Petition

Your case is filed, and protections immediately begin.

- Automatic Stay

Mortgage lenders and creditors have to halt the collection and foreclosure activities.

- Submit Repayment Plan

It is a 3-5 year repayment plan, in which you can have all debts combined in a single manageable monthly payment.

- Court Approval

A bankruptcy judge reviews and confirms your plan. Creditors are legally obliged to it as soon as it is approved.

- Completion

After 3–5 years of steady payments, remaining eligible debts are discharged, and you keep your home, car, and other protected assets.

Don’t Make These 5 Mistakes While Filing Bankruptcy (Chapter 7 & Chapter 13)

Filing for bankruptcy in San Diego can give you a fresh start — but only if you avoid the common mistakes that trip people up. Here’s what you need to know:

What NOT to Do Before Filing

- Do NOT max out your credit cards. Running up debt right before filing can be considered fraud, and the court may refuse to discharge those balances.

- Do NOT transfer assets to friends or family. Giving away property or “hiding” money before filing looks like you’re trying to cheat the system. A trustee can undo these transfers and it can damage your case.

- Do NOT drain retirement accounts. Most retirement funds are protected by exemptions — but once you cash them out, that money may not be safe.

What NOT to Do After Filing

- Do NOT hide income. The court requires complete honesty. If new income shows up and you don’t disclose it, your case could be dismissed.

- Do NOT ignore trustee requests. If the bankruptcy trustee asks for documents, missing deadlines or refusing to cooperate will jeopardize your case.

And keep in mind that bankruptcy doesn’t clear all debts… because some debts are not dischargeable, like:

- Student loans (in most cases)

- Child support and alimony

- Certain taxes and fines

Bankruptcy gives you major relief, but it won’t erase everything.

Life After Bankruptcy Isn’t the End.

While Chapter 7 stays on your report for 10 years and Chapter 13 for 7, you can start rebuilding credit within months through secured cards, timely payments, and low balances.

Within 6 months, you can often qualify for small credit lines again. Within 2 years, many people qualify for car loans and some even for mortgages with better terms than before.

But the wrong choice can mean losing assets or staying stuck in debt.

At SanDiegoBK, we’ve guided thousands of San Diegans through this decision and helped them protect their precious assets.