Rising costs, unpredictable markets, and debt piling faster than revenue are the challenges businesses face across San Diego.

But the issue is that owners don’t believe bankruptcy can save their businesses. And most resistance comes from emotion, not facts.

Here’s why business owners hesitate to file bankruptcy:

- Many owners equate filing with personal failure. They fear being judged

- They think the court will take over the business.

- They confuse Chapter 11 with liquidation, not realizing it’s about reorganization.

- They are afraid customers, lenders, or suppliers will lose trust.

- Legal fees and paperwork feel overwhelming when money is already tight.

If you’re staring at debt and wondering if there’s a way out, Chapter 11 can save your business.

In this blog, we’ll break down the essential Do’s and Don’ts of Chapter 11 bankruptcy for San Diego business owners and strategies to rebuild stronger.

Basic Understanding of Chapter 11 Bankruptcy for Small Business Owners

Chapter 11 is just as available (and often more useful) to small businesses in San Diego as it is to big corporations like airlines, hotel chains, retail giants, etc.

Reorganization vs. Liquidation

Unlike Chapter 7 bankruptcy, which liquidates (sells off) your assets to pay creditors, Chapter 11 is about reorganization.

That means you keep operating, keep employees on payroll, and get breathing room from creditors while you restructure your debt into something manageable.

In short, Chapter 11 doesn’t shut down your business. It will stay alive.

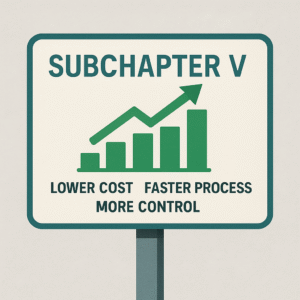

Subchapter V — Built for Small Businesses

For local entrepreneurs, the 2019 Small Business Reorganization Act created Subchapter V of Chapter 11.

Here’s the list of perks of Subchapter V:

- Lower costs: It has fewer administrative hurdles and attorney fees.

- Faster process: It streamlines timelines that prevent endless court delays.

- More control: Owners often keep equity in the business, unlike traditional Chapter 11 cases, where creditors may take over.

If your total debt falls under certain thresholds, Subchapter V is usually the smartest path forward.

Who Actually Benefits from Chapter 11?

- Businesses with strong customer demand but temporary financial strain (e.g., seasonal downturns, one-time shocks like COVID debt).

- Companies with employees or long-term contracts worth protecting (restaurants, gyms, construction firms).

- Owners who want to restructure debt instead of shutting down.

Remember, it depends from condition to condition, that’s why professional help is very important.

Anyhow, Chapter 11 is for all business owners who believe their company is worth saving.

5 Do’s of Chapter 11 Bankruptcy (Essentials to Save Your Case)

For filing Chapter 11, you have to make the right moves early and often. Here are the essential Do’s every San Diego business owner should follow:

-

Do Consult a Bankruptcy Attorney Early

Business bankruptcies are complex, and the earlier you bring in an experienced attorney, the more options you’ll have. An attorney can help you decide between traditional Chapter 11 or Subchapter V.

-

Do Gather Complete Financial Records (and Stay Transparent)

The court and your creditors want clarity. That means tax returns, payroll records, vendor contracts, loan documents, leases…hiding or forgetting them only damages your credibility. Transparency builds trust and increases the odds your plan gets approved.

-

Do Prepare a Realistic Reorganization Plan

A Chapter 11 filing is only as good as the plan behind it. Your proposal to creditors needs to show how you’ll realistically turn things around. Be conservative, be practical, and build in contingencies. Creditors respect numbers that add up, not empty promises.

-

Do Use Subchapter V If Eligible

If you’re a small business in San Diego, Subchapter V can be a lifeline. It trims down costs, accelerates timelines, and lets you keep more control over your business. If you qualify, don’t leave this option on the table.

-

Do Communicate With Stakeholders

Keep in touch with your employees, suppliers, landlords, and even loyal customers. Silence during bankruptcy kills trust. Be proactive.

The businesses that survive Chapter 11 are the ones that keep their community of stakeholders informed and engaged.

5 Don’ts of Chapter 11 Bankruptcy (Must Avoid)

These common pitfalls can derail your Chapter 11 case before it even gains traction.

-

Don’t Hide Assets or Favor “Insiders”

Courts have zero tolerance for dishonesty. If you try to tuck assets away, move money to family members, or give preferential payments to insiders, the court can (and will) claw them back. Worse, you could lose the trust of creditors and the judge — and that’s nearly impossible to recover from.

-

Don’t Rack Up New Debt Before Filing

Running up credit cards or taking out fresh loans right before bankruptcy looks like bad faith. Judges and creditors will see it as trying to game the system, and it could kill your reorganization plan. If you’re considering Chapter 11, stop adding new obligations immediately.

-

Don’t Ignore Payroll or Taxes

Payroll and taxes are non-negotiable. Missing them during a bankruptcy case can bring severe penalties and even personal liability. Staying current on these obligations is one of the fastest ways to show the court you’re serious about keeping your business alive.

-

Don’t Underestimate the Time & Costs

Chapter 11 isn’t a quick fix. Even Subchapter V takes months, and traditional Chapter 11 can stretch much longer. Between attorney fees, court costs, and professional expenses, the process requires financial planning. Go in with your eyes open.

-

Don’t Try to DIY

Business bankruptcies are a different beast from personal filings. The laws, reporting requirements, and negotiations are too complex to manage without legal guidance. Trying to self-file almost always ends in dismissal and wasted time you don’t have.

How These 5 Common Mistakes Can Make or Break Your Case

These errors can turn a second chance into a dead end.

1.Filing Too Late

Waiting until creditors sue, bank accounts are frozen, or assets are seized makes Chapter 11 much harder to pull off. By then, you’ve lost leverage. The sooner you file the more you have on the table.

2.Submitting a Weak or Unrealistic Plan

Courts and creditors require realistic figures, attainable schedules and a defined plan. In such a way, your plan is a dead man walking.

3.Poor Cash Management During the Case

The courts will be keeping a close watch on the business finances with regard to bankruptcy. Misjudge costs, forget to file reports, or allow accounts to take a nosedive, and you’ll lose credibility in no time – and creditors will press the liquidation button.

4. Not Securing DIP Financing When Needed

The lifeline that keeps it running in the event of bankruptcy can be debtor-in-possession (DIP) financing. Failing to do it, or taking excessive time to do so, may end up starving your business with a lack of working capital at the worst time possible.

5. Miscommunication With Employees

The lifeline that keeps it running in the event of bankruptcy can be debtor-in-possession (DIP) financing. Failing to do it, or taking excessive time to do so, may end up starving your business with a lack of working capital at the worst time possible.

The prevention of these errors is often the difference between business ventures that come out of Chapter 11 and those that fail to last because of slip-ups.

Follow These 5 Steps to Rebuild and Move Forward After Chapter 11

Emerging from Chapter 11 is the beginning of your business’s second chance. The way you handle the “after” phase will determine whether you simply survive… or truly thrive.

-

Completing the Plan = Restoring Credibility

It is not just that you clear your debt by successfully using your court-approved repayment program. It is an indicator to creditors, vendors, and the market that your business is capable of making good on promises. Before Chapter 11, credibility may be lost, but after it, this credibility may be restored by consistency.

-

Rebuilding Business Credit

Lenders will keep a close check on your track record after bankruptcy. Make payments in time, maintain small balances, and think about the secured credit option to re-establish your profile. Eventually, you will be able to borrow and expand again.

-

Regaining Employee & Customer Trust

Be consistent by updating your employees, rewarding them, and scoring little wins. Even customers would like to know that you are not a fly-by-night enterprise. Provide quality service, remain visible, and build loyalty.

-

Attracting Future Financing

It can be refinanced after Chapter 11, yes. What will attract the lenders are indicators that you have learned your lesson: better cash management, more realistic growth ideas, and a previous track record of fulfilling commitments. A well-executed reorganization will, in fact, help to make your business more attractive to investors who are sensitive to resilience.

-

Using Chapter 11 as a Launchpad

When you have Chapter 11 in place, it works to safeguard assets, save jobs, and provide a business in San Diego with an opportunity to reestablish itself in a competitive market.

Chapter 11 Can Protect Your Business (& Future As Well).

Chapter 11 is for business owners who feel the weight of debt but still believe in their business. By understanding the do’s, avoiding the don’ts, and steering clear of common mistakes, you position yourself to emerge stronger on the other side of Chapter 11.

The path isn’t easy, but the San Diego business bankruptcy lawyer support can save both your business and your peace of mind. Reach out today for a confidential consultation and take the first step toward protecting your business.